Q: AS A Landlord I am noticing that my rental profits will drop this year as a result of new Government taxes.

What will the effect of this be over the next five years?

A: April 5 is almost upon up on us and the end of another tax year which means the tax returns are then due for Landlords by January 31, 2019.

It will also mean that the amount of tax relief you are able to claim for interest on your rental mortgage starts to fall from 100 per cent to 75 per cent in 2017/18 and to 50 per cent in 2018/19.

For the majority of Landlords this will result in higher tax bills.

For 2019/20 this falls further to 25 per cent and zero in 2020/21 when it will be replaced with a 20 per cent tax credit.

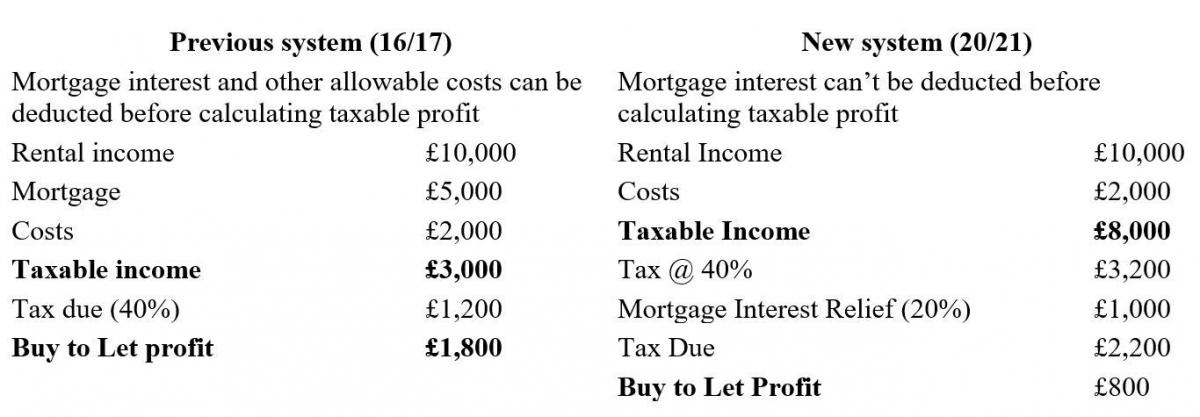

I will provide you with an example, for illustration purposes assuming that you have a rental income £10,000, mortgage interest £5,000 and other taxable expenses £2,000.

Assuming 40 per cent tax bracket

(see figure 1)

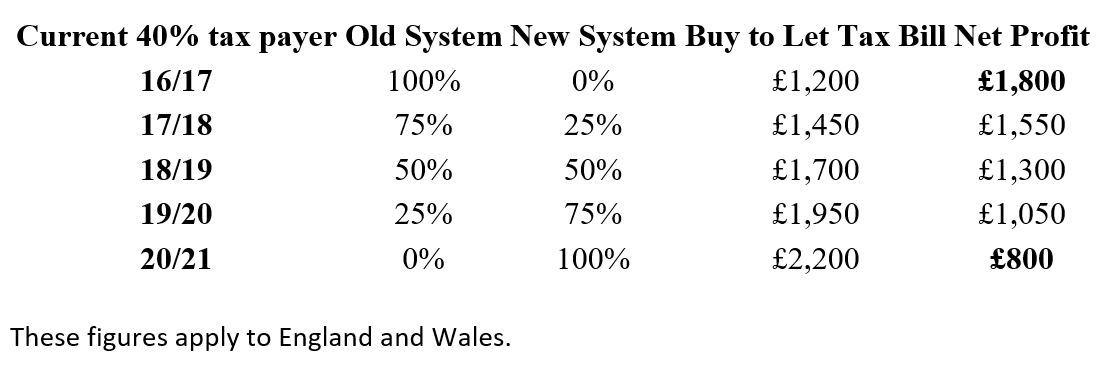

Should we break this down year by year we end up with the following results again assuming your rental incomes takes you into the 40 per cent tax bracket?

(see figure 2)

These figures apply to England and Wales.

These will make some noticeable differences to Landlords, particularly those with high outstanding mortgages.

Noticeable examples would be Landlords with endowment mortgagees where only the interest element is paid off each year and interest only mortgages where Landlords may have an alternative lump sum payment plan at maturity.

As a result of the changes, there has been a noticeable change around for some buy to let investors.

Some have either looked to seek alternative more tax efficient investments, some have sold some of their existing portfolio or looked at ways to increase rents to compensate for the losses due to be incurred.

For Landlords without mortgages, these changes will make no difference and owner occupiers maybe of the opinion that this is long overdue.

After all owner occupiers used to receive interest relief on their mortgages that was introduced by Geoffrey Howe back in 1983 and abolished by Nigel Lawson in 1988.

Though it is argued that this fuelled the sharp increase in house prices which resulted in the 1989 house price crash!

I do not feel that the real effect will really hit home until Landlords actually compile their own personal figures later in the year or have their accountants sit them down to say well this is what you owe this year that the implications will really sink it.

Only then can you decide whether to sell up or take the opinion that being a Landlord is a long term investment.

Put another way you either sink or swim…

Please continue to send in your letting related questions to steven@sawyersestateagents.co.uk

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here