Q: AS A tenant our gas boiler is dated and we still lack basic efficiency measure, what are the consequences of this for my landlord?

A: Taxes, what are taxes you may say, we all loath them yet we all end up paying them, or we should, in one form or another.

Whether this is VAT or income tax, the net result is that we have less in our pockets and gone are the days when many grants were available to ease our financial burdens.

Applying this to Landlords we once had a time when Landlords could obtain grants often without financial cost or penalty to deal with the up-grade of their properties.

Recently there was the Green Deal scheme which meant that Landlords could obtain new gas boilers, cavity wall insulation and loft insulation free of charge with the cost met by their tenants in the form of reduced energy bills from the savings of more energy efficient improvements.

However the scheme was flawed in that it was the tenants who were paying for the improvements which many considered completely wrong, because if tenants changed then the new tenants would also be caught within the scheme even though they had no dealings with the original improvements.

As a letting agents we did not endorse any such scheme as it was fundamentally unfair for tenants.

The Department of Business, Energy and Industrial Strategy say that improvements should be the responsibility of the Landlords after all its the Landlords properties that typically increase in value as a result of such improvements, especially those involving a new replacement boiler.

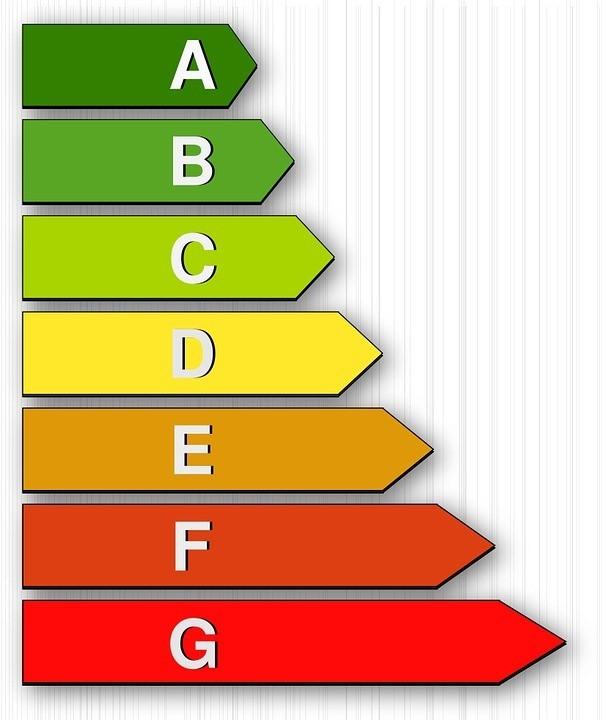

From April 2018 the energy performance certificate scores for all rented properties (excluding those listed) must raise the energy efficiency to at least an E band.

It is estimated that in the region 330,000 have F and G bandings which require major work to bring them up to standard.

Some commentators are of the opinion that to achieve this all that will happen is that Landlords will increase rental valves to pay for the improvements.

I would disagree as rental prices are market driven not epc score driven.

However, this for some is considered another stealth tax burden that Buy-to-Let Landlords must take into account when looking for investments.

These measures may prohibit entry into the market which will reduce the available and then ‘Yes’ this can push rents up due to a shortage of properties to let.

We have already seen this in Stroud over the last 12 months as many will have noticed that rental prices have increased due to increased demand and a lack of supply.

However increases in rent reduces disposable income, that reduces what we have spare to spend on keeping the local economy rolling over, reducing tax income in the form of less VAT.

The net conclusions to balance out deficiencies is that we need more properties built and until this happens, things aren’t set to change.

Please continue to send in your letting related questions to steven@sawyersestateagents.co.uk

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here